The Ultimate Trading Guide: 65. Trading Bots

In the fast-paced world of financial markets, traders are constantly seeking ways to optimize their strategies and improve efficiency. Trading bots, also known as automated trading systems or expert advisors, have emerged as powerful tools to automate trading processes and execute strategies with precision and speed. These bots are programmed to follow predefined rules and execute trades automatically, eliminating human emotions and biases from the trading equation. In this comprehensive piece by BellsForex, we will delve into the world of trading bots, exploring their benefits, strategies, and the practical application of automated trading through a case study.

Understanding Trading Bots

What Are Trading Bots?

Trading bots are computer programs that execute trades automatically based on predefined criteria and algorithms. These bots can analyze market data, identify trading opportunities, and place orders without human intervention. They are designed to operate 24/7, continuously monitoring the markets and executing trades with speed and precision.

Types of Trading Bots

- Trend-following Bots: These bots identify and capitalize on trends in the market, either by buying in an uptrend or selling in a downtrend.

- Arbitrage Bots: Arbitrage bots exploit price differences between different exchanges or markets to generate profit.

- Mean Reversion Bots: These bots capitalize on the tendency of prices to revert to their mean or average value after a period of deviation.

- Scalping Bots: Scalping bots aim to profit from small price movements by executing a large number of trades in a short period.

Benefits of Using Trading Bots

1. Elimination of Emotions

One of the primary advantages of trading bots is the elimination of emotions from the trading process. Bots operate based on predefined rules and algorithms, removing the influence of fear, greed, or other emotional biases that often affect human traders.

2. Backtesting and Optimization

Trading bots can be backtested using historical data to assess their performance under different market conditions. Traders can optimize their strategies based on past performance, allowing them to fine-tune their bots for better results.

3. Speed and Efficiency

Bots can execute trades with lightning-fast speed, enabling traders to capitalize on even the smallest price movements. They can react to market conditions in real-time, ensuring timely execution of trades without delays.

4. Diversification

Automated trading systems allow traders to diversify their portfolios by executing multiple strategies simultaneously across different assets and markets. This diversification helps spread risk and enhance overall portfolio performance.

5. 24/7 Market Monitoring

Trading bots can operate 24 hours a day, seven days a week, continuously monitoring the markets for trading opportunities. This ensures that traders do not miss out on potential profit-making opportunities, even when they are not actively monitoring the markets.

Strategies for Using Trading Bots

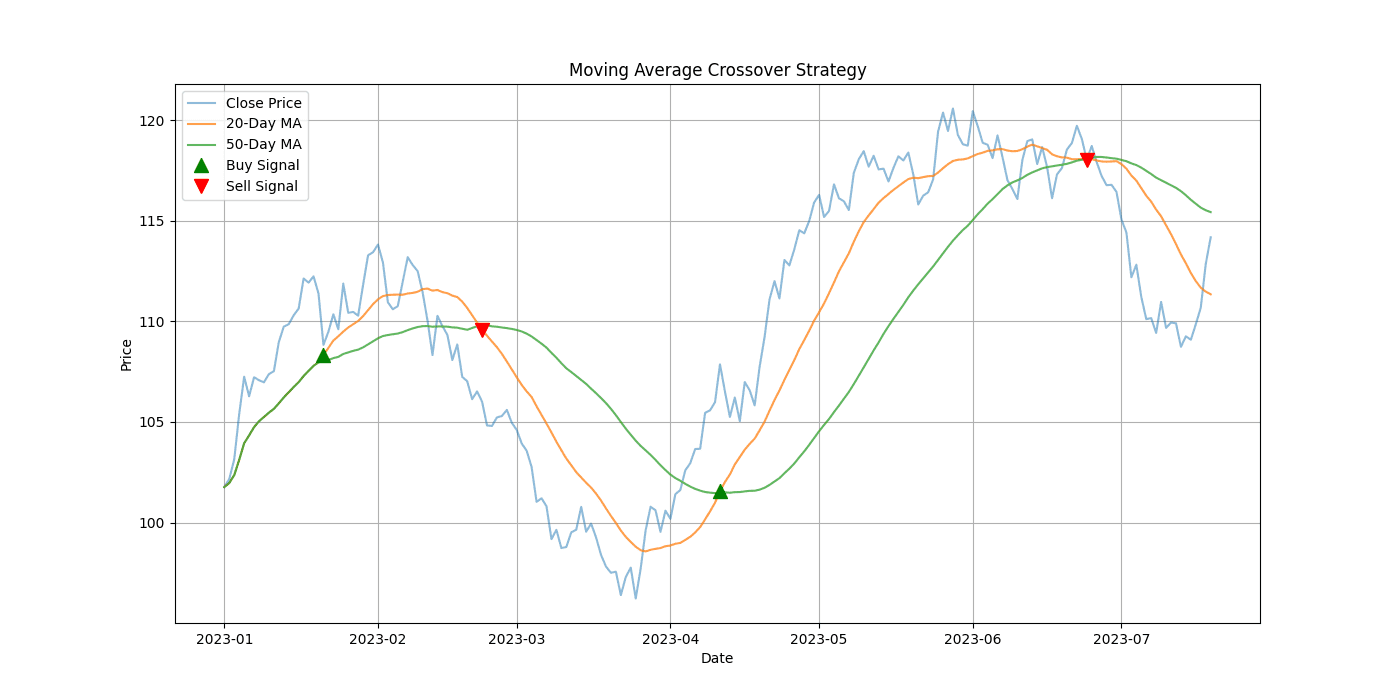

1. Moving Average Crossover

This strategy involves using two moving averages with different time periods. When the shorter-term moving average crosses above the longer-term moving average, it generates a buy signal. Conversely, when the shorter-term moving average crosses below the longer-term moving average, it generates a sell signal.

2. Bollinger Bands Breakout

In this strategy, the trading bot monitors the price movements relative to the Bollinger Bands. When the price breaks above the upper band, it generates a buy signal, indicating a potential uptrend. Conversely, when the price breaks below the lower band, it generates a sell signal, indicating a potential downtrend.

3. RSI (Relative Strength Index) Divergence

The RSI divergence strategy involves using the Relative Strength Index to identify potential trend reversals. When the price makes a new high, but the RSI fails to confirm the high (forming a lower high), it indicates a bearish divergence and generates a sell signal. Conversely, when the price makes a new low, but the RSI fails to confirm the low (forming a higher low), it indicates a bullish divergence and generates a buy signal.

Case Study: Implementing a Moving Average Crossover Strategy

John is a forex trader who wants to automate his trading strategy using a moving average crossover. He believes that this strategy can help him identify trends and capture potential profit opportunities in the currency markets.

Strategy Setup

- Moving Averages: John decides to use a 50-period and a 200-period simple moving average (SMA) for his crossover strategy.

- Entry Signal: When the 50-period SMA crosses above the 200-period SMA, it generates a buy signal, indicating a potential uptrend.

Conversely, when the 50-period SMA crosses below the 200-period SMA, it generates a sell signal, indicating a potential downtrend.

Bot Configuration

John selects a popular trading platform that supports automated trading and expert advisors. He programs the bot to execute the following rules:

- Buy Signal: If the 50-period SMA crosses above the 200-period SMA, the bot will place a buy order for a specified currency pair.

- Sell Signal: If the 50-period SMA crosses below the 200-period SMA, the bot will place a sell order for the same currency pair.

Trade Execution

Buy Signal

On June 1st, the 50-period SMA crosses above the 200-period SMA, generating a buy signal for the EUR/USD currency pair. The bot executes a buy order at 1.1200.

Sell Signal

On August 15th, the 50-period SMA crosses below the 200-period SMA, generating a sell signal for the EUR/USD currency pair. The bot executes a sell order at 1.1100.

Results

- Buy Entry Price: 1.1200

- Sell Exit Price: 1.1100

- Profit per Pip: 100 pips

- Total Profit: $1,000 (10,000 pips * $0.10 per pip)

Analysis

John’s automated trading bot successfully executed the moving average crossover strategy, generating a profit of $1,000. By removing human emotions from the trading process and automating the strategy, John was able to capture profit opportunities in the forex market with precision and efficiency.

Final Remarks

Trading bots offer numerous benefits to traders, including the elimination of emotions, backtesting and optimization, speed and efficiency, diversification, and 24/7 market monitoring. By using trading bots, traders can automate their strategies, execute trades with precision, and capitalize on profit opportunities in the financial markets.

The case study of John’s moving average crossover strategy demonstrates the practical application of trading bots in automating trading strategies.