The Ultimate Trading Guide: 11. Learn Chart Patterns

In the world of trading, technical analysis plays a crucial role in making informed decisions. Among the various tools used in technical analysis, chart patterns are particularly significant. Chart patterns help traders identify potential reversals or continuations in market trends. This comprehensive guide by BellsForex will delve into the most popular chart patterns, including the head and shoulders, double tops, and triangles, providing traders with the knowledge they need to recognize and use these patterns effectively.

Introduction to Chart Patterns

Chart patterns are formations created by the movements of security prices on a chart. These patterns are used by traders to predict future price movements based on historical data. Chart patterns are broadly categorized into two types: reversal patterns and continuation patterns.

- Reversal Patterns: Indicate that a prevailing trend is about to reverse direction.

- Continuation Patterns: Suggest that a current trend will continue after a brief period of consolidation.

Understanding these patterns is essential for traders to make timely and profitable trading decisions.

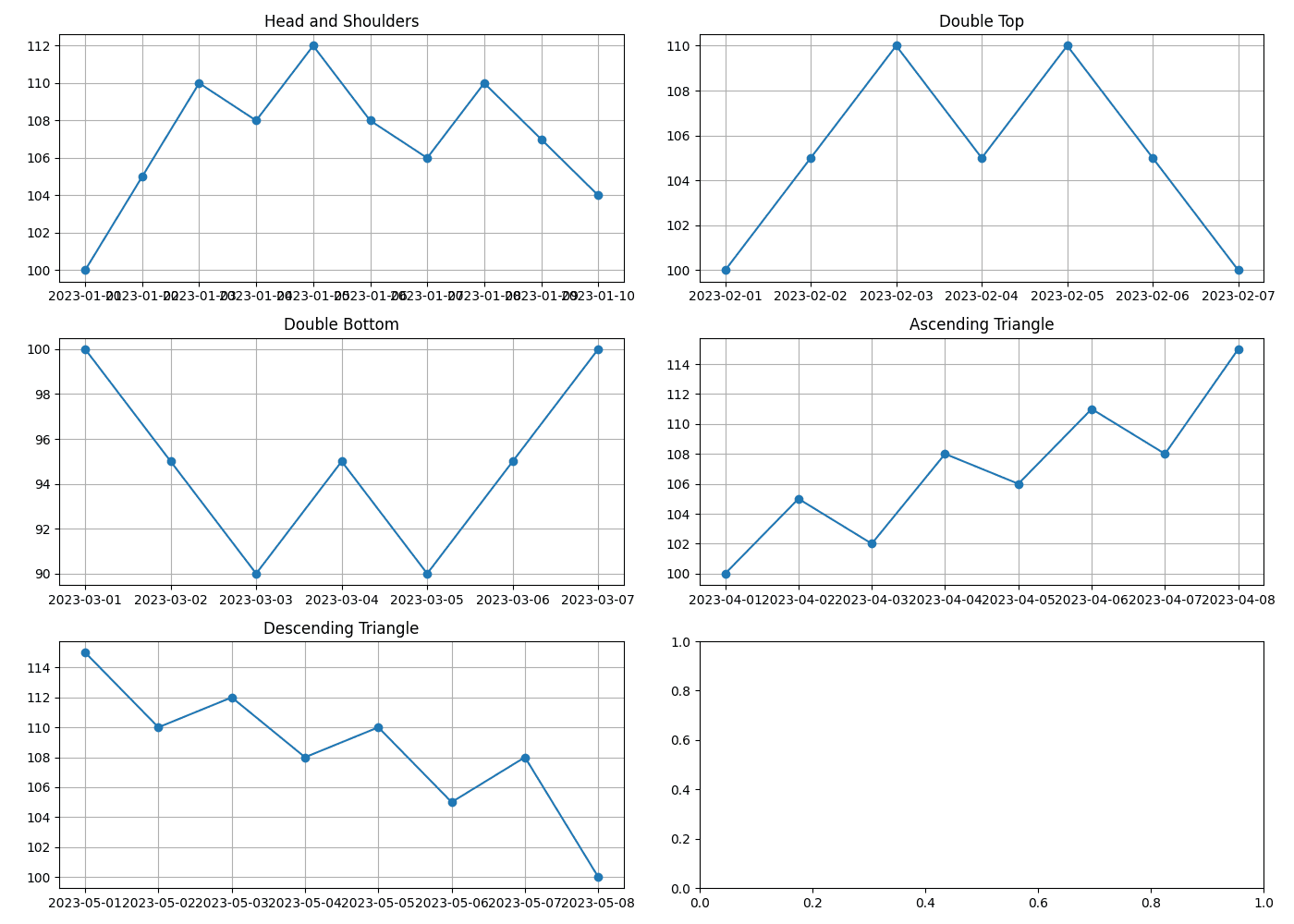

Head and Shoulders Pattern

Description

The head and shoulders pattern is one of the most reliable reversal patterns. It signals the end of an uptrend and the beginning of a downtrend. This pattern consists of three peaks: a higher peak (the head) between two lower peaks (the shoulders).

Components

- Left Shoulder: The first peak forms the left shoulder, followed by a decline.

- Head: The second peak is higher than the first and forms the head, followed by another decline.

- Right Shoulder: The third peak is lower than the head and approximately equal to the left shoulder.

- Neckline: A support level that connects the lows after the left shoulder and the head.

Formation

- Uptrend: The pattern starts forming in an uptrend.

- Left Shoulder: Price rises to form a peak and then declines.

- Head: Price rises again to form a higher peak and then declines to form the second low.

- Right Shoulder: Price rises again to form a lower peak (right shoulder) and then declines.

- Neckline Break: The pattern is confirmed when the price breaks below the neckline.

Trading Strategy

- Entry Point: Enter a short position when the price breaks below the neckline.

- Stop Loss: Place a stop loss above the right shoulder.

- Target: The target is calculated by measuring the distance from the head to the neckline and projecting it downward from the neckline.

Inverse Head and Shoulders

The inverse head and shoulders pattern is the opposite of the head and shoulders pattern and signals a reversal from a downtrend to an uptrend.

Double Tops and Double Bottoms

Double Tops

Description

The double top is a bearish reversal pattern that occurs after an uptrend. It is characterized by two consecutive peaks at roughly the same level, separated by a moderate decline.

Components

- First Peak: The price reaches a high and then declines.

- Second Peak: The price rises again to the same level as the first peak and then declines.

- Neckline: The support level connecting the lows between the two peaks.

Formation

- Uptrend: The pattern forms after an uptrend.

- First Peak: Price rises to a peak and then declines to form a low.

- Second Peak: Price rises again to the same level as the first peak and then declines.

- Neckline Break: The pattern is confirmed when the price breaks below the neckline.

Trading Strategy

- Entry Point: Enter a short position when the price breaks below the neckline.

- Stop Loss: Place a stop loss above the second peak.

- Target: The target is calculated by measuring the distance from the peaks to the neckline and projecting it downward from the neckline.

Double Bottoms

The double bottom is the bullish counterpart to the double top. It signals a reversal from a downtrend to an uptrend and is characterized by two consecutive lows at roughly the same level, separated by a moderate rise.

Formation

- Downtrend: The pattern forms after a downtrend.

- First Low: Price declines to a low and then rises to form a high.

- Second Low: Price declines again to the same level as the first low and then rises.

-

Neckline Break: The pattern is confirmed when the price breaks above the neckline.

Trading Strategy

- Entry Point: Enter a long position when the price breaks above the neckline.

- Stop Loss: Place a stop loss below the second low.

- Target: The target is calculated by measuring the distance from the lows to the neckline and projecting it upward from the neckline.

Triangles

Triangles are continuation patterns that indicate a period of consolidation before the trend continues in its original direction. There are three types of triangles: ascending, descending, and symmetrical.

Ascending Triangle

Description

The ascending triangle is a bullish continuation pattern characterized by a horizontal resistance level and an upward sloping support line.

Formation

- Resistance Level: A horizontal line that connects the highs.

- Support Line: An upward sloping line that connects the higher lows.

Trading Strategy

- Entry Point: Enter a long position when the price breaks above the resistance level.

- Stop Loss: Place a stop loss below the most recent low.

- Target: The target is calculated by measuring the height of the triangle and projecting it upward from the breakout point.

Descending Triangle

Description

The descending triangle is a bearish continuation pattern characterized by a horizontal support level and a downward sloping resistance line.

Formation

- Support Level: A horizontal line that connects the lows.

- Resistance Line: A downward sloping line that connects the lower highs.

Trading Strategy

- Entry Point: Enter a short position when the price breaks below the support level.

- Stop Loss: Place a stop loss above the most recent high.

- Target: The target is calculated by measuring the height of the triangle and projecting it downward from the breakout point.

Symmetrical Triangle

Description

The symmetrical triangle can indicate either a continuation or a reversal, depending on the direction of the breakout. It is characterized by converging trendlines, with one sloping upwards and the other downwards.

Formation

- Converging Trendlines: One upward sloping line connecting higher lows and one downward sloping line connecting lower highs.

Trading Strategy

- Entry Point: Enter a position (long or short) depending on the direction of the breakout.

- Stop Loss: Place a stop loss below the most recent low (for a bullish breakout) or above the most recent high (for a bearish breakout).

- Target: The target is calculated by measuring the height of the triangle and projecting it in the direction of the breakout.

Case Study: Identifying and Trading a Head and Shoulders Pattern

Background

John, an experienced trader, noticed a potential head and shoulders pattern forming on the daily chart of EUR/USD. He decided to use this pattern to inform his trading strategy.

Pattern Formation

- Left Shoulder: John observed that EUR/USD formed a peak at 1.2000 and then declined to 1.1800.

- Head: The price then rose to 1.2200, forming a higher peak, and declined again to 1.1800.

- Right Shoulder: The price rose once more to 1.2000, forming the right shoulder, and then started declining.

Neckline

John drew the neckline by connecting the lows at 1.1800.

Entry Point

John waited for the price to break below the neckline. When EUR/USD fell to 1.1750, he entered a short position.

Stop Loss and Target

- Stop Loss: John placed his stop loss at 1.2100, above the right shoulder.

- Target: He measured the distance from the head (1.2200) to the neckline (1.1800), which was 400 pips. He projected this distance downward from the neckline, setting his target at 1.1400.

Outcome

The EUR/USD continued to decline, reaching John's target at 1.1400. This successful trade reinforced his confidence in using the head and shoulders pattern for identifying trend reversals.

Final Remarks

Recognizing and trading chart patterns such as the head and shoulders, double tops, and triangles can significantly enhance a trader's ability to predict market movements and make informed decisions. These patterns provide valuable insights into potential reversals and continuations, helping traders to enter and exit positions more effectively.

By mastering these chart patterns, traders can improve their technical analysis skills and increase their chances of achieving consistent profitability. We emphasize the importance of continuous learning and practice in becoming proficient in identifying and trading these patterns. With dedication and a thorough understanding of chart patterns, traders can navigate the complexities of the financial markets with greater confidence and success.