120 Trading Tips

Welcome to our comprehensive guide to trading success! Whether you're a seasoned trader or just starting out, mastering the art of trading requires more than just intuition—it demands discipline, strategy, and continuous learning. To help you navigate the complexities of the financial markets, we've compiled 120 actionable tips designed to enhance your trading skills, minimize risks, and maximize your potential returns.

Mastering the Essentials

From controlling emotions and managing risk to staying informed and refining your strategies, these tips cover every aspect of trading. Dive in, absorb the wisdom, and apply these insights to elevate your trading game. Remember, consistency and continuous improvement are the keys to long-term success in the markets. Let's get started!

|

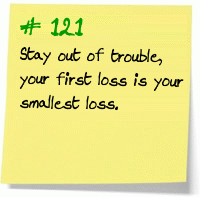

2. Cut Losses Quickly: Set stop-loss orders and stick to them to minimize potential losses | 3. Diversify: Spread your investments across different assets to reduce risk |  |

5. Stay Informed: Keep up with market news and trends to make informed decisions.. |

| 6. Control Emotions: Avoid making impulsive trades driven by fear or greed. | 7. Start Small: Begin with smaller positions, especially if you're new to trading, to manage risk better |  |

9. Use a Trading Plan: Develop and follow a well-defined trading plan to stay disciplined. |  |

| 11. Be Patient: Wait for the right trading opportunities instead of forcing trades. |  |

|

|

15. Know Your Exit Points: Plan your exits before entering a trade, both for taking profits and cutting losses. |

16. Keep Learning: Continuously educate yourself on trading strategies, market analysis, and new tools. |

17. Review Your Trades: Regularly analyze your past trades to identify mistakes and improve your strategy. | 18. Focus on Risk Management: Never risk more than a small percentage of your capital on a single trade. | 19. Avoid Overtrading: Don’t trade too frequently; wait for high-probability setups. | 20. Follow Market Trends: Trade in the direction of the prevailing market trend for higher success rates. |

| 21. Stay objective and minimize emotional decisions. | 22. Diversify your portfolio, but avoid excessive diversification. | 23. Create a plan and follow it diligently. | 24. Implement stop-loss orders to protect against significant losses. | 25. Allow your winners to run, and exit losing trades quickly. |

|

|

|

|

|

| 31. Use Technical Analysis: Leverage charts and indicators to identify entry and exit points. | 32. Stay Calm Under Pressure: Maintain a clear mind during market volatility, to avoid rash decisions. | 33. Journal Your Trades: Keep a detailed record of your trades to track performance and refine your strategy. | 39. Respect Market Hours: Be aware of market opening and closing times, as these can be volatile periods. | 35. Set Realistic Goals: Aim for consistent, small gains rather than trying to hit big wins. |

| 36. Be Wary of Leverage: Use leverage cautiously, as it can amplify both gains and losses. | 37. Stay Updated on Economic Events: Monitor economic calendars for key events that could impact markets. | 38. Trade What You Understand: Stick to markets and instruments you’re familiar with to make informed decisions. | 39. Avoid Chasing Losses: Don’t try to recover losses by increasing your trade size; this can lead to bigger losses. | 40. Use Limit Orders: Limit orders can help you control entry and exit prices, reducing the impact of market volatility. |

|

|

|

|

|

| 46. Stay Disciplined: Avoid deviating from your trading strategy, even when tempted by potential quick gains. | 47. Understand Market Sentiment: Pay attention to market sentiment indicators to gauge the mood of the market. | 48. Test Strategies in a Demo Account: Practice new strategies in a risk-free environment before applying them in live trading. | 49. Know Your Trading Style: Determine whether you’re a day trader, swing trader, or long-term investor, and tailor your strategy accordingly. | 50. Beware of Confirmation Bias: Avoid seeking out information that only supports your existing views; consider all evidence objectively. |

|

52. Avoid Trading on Rumors: Base your trades on solid analysis, not on unverified information or market rumors. | 53. Mind Your Position Sizing: Adjust your position size based on the volatility of the asset and your risk tolerance. | 54. Focus on Quality Over Quantity: It's better to make a few well-researched trades than many impulsive ones. |  |

| 56. Learn to Walk Away: If the market conditions aren’t favorable, sometimes the best trade is no trade. |

|

|

59. Stay Hydrated and Rested: Physical and mental well-being are crucial for maintaining focus and making sound decisions. | 60. Use Moving Averages: Simple moving averages can help you identify trends and potential reversals. |

| 61. Don’t Be Afraid to Take Profits: If a trade is going well, don’t hesitate to lock in profits, even if the move isn’t complete. | 62. Set Alerts: Use price alerts to notify you of significant market movements, so you don’t have to monitor the market constantly. | 63. Avoid Overconfidence: Even experienced traders can make mistakes; always stay humble and cautious. | 64. Stay Away from Illiquid Markets: Trade in markets with sufficient liquidity to ensure you can enter and exit positions easily. | 65. Watch Out for Fees: Be mindful of trading fees and commissions, as they can eat into your profits over time. |

| 66. Adapt to Market Conditions: Be flexible and willing to adjust your strategy as market conditions change. | 67. Keep Emotions Separate: Don’t let personal feelings or recent experiences cloud your trading judgment. | 68. Focus on Risk-Reward Ratios: Always evaluate the potential reward of a trade relative to the risk you’re taking. | 69. Use Support and Resistance Levels: Identify key support and resistance levels to guide your entry and exit points. | 70. Be Aware of Market Correlations: Understand how different markets or assets may be correlated to avoid overexposure. |

| 71. Educate Yourself on Economic Indicators: Learn how economic indicators affect the markets you trade. | 72. Follow the News Cycle: News events can cause significant market movements, stay informed to anticipate changes. |  |

|

|

|

|

|

|

|

| 81. Trust Your Analysis: Rely on your research and analysis rather than following the crowd or rumors. |  |

83. Use Trend Lines: Draw trend lines on charts to help visualize the market’s direction and potential reversal points. | 84. Don’t Overcomplicate Your Strategy: Keep your trading strategy simple to make quick, confident decisions. |

|

| 86. Stay Calm After Losses: Accept that losses are part of trading, and avoid making emotional decisions to recover quickly. | 87. Be Cautious with Overnight Positions: Holding positions overnight exposes you to after-hours events and market gaps. | 88. Avoid Revenge Trading: Don’t try to immediately win back losses by entering new trades without proper analysis. | 89. Regularly Update Your Knowledge: Markets and trading tools evolve, so keep learning to stay ahead. | 90. Use Volume Indicators: Pay attention to trading volume, as it can confirm trends or signal potential reversals. |

| 91. Beware of Confirmation Bias: Always challenge your assumptions and consider alternative viewpoints before entering a trade. | 92. Manage Your Trading Environment: Create a distraction-free workspace to stay focused during trading hours. | 93. Pay Attention to Interest Rates: Interest rate changes can have a significant impact on various markets, especially currencies and bonds. | 94. Keep an Eye on Institutional Activity: Large institutional trades can move markets; understanding their behavior can offer valuable insights. | 95. Avoid Over-Optimizing: Don’t overly tweak your trading strategy based on past data; it might not perform well in real-time conditions. |

| 96. Avoid Trading During Low Liquidity: Markets with low liquidity can lead to unpredictable price movements and wider spreads. | 97. Use Multiple Time Frames: Analyze multiple time frames (e.g., daily, hourly) to get a comprehensive view of market trends. | 98. Backtest Your Strategies: Before implementing a strategy, backtest it using historical data to see how it would have performed. | 99. Stay Objective: Stick to your trading plan and avoid making decisions based on personal biases or preferences. | 100. Consider Seasonal Trends: Some markets exhibit seasonal patterns that can influence price movements. |

| 101. Maintain a Trading Routine: Develop and stick to a consistent routine that includes regular market analysis and review of trades. | 102. Focus on One Market at a Time: Especially when starting out, it’s easier to master one market or asset before diversifying. | 103. Know Your Broker: Choose a reliable broker with a good reputation and transparent fee structures. | 104. Use Caution with Penny Stocks: While they might seem appealing due to low prices, penny stocks are highly volatile and risky. | 105. Avoid Emotional Attachment: Don’t get emotionally attached to a position; be always ready to exit. |

| 106. Understand Market Psychology: Recognize the influence of collective trader behavior and sentiment on market trends. | 107. Be Cautious with High-Frequency Trading: Rapid trading strategies require advanced tools and can be riskier for traders. | 108. Use Protective Stops: Implement trailing stops to lock in profits as the market moves in your favor. | 109. Keep a Long-Term Perspective: Even in short-term trading, it’s important to have a long-term perspective on market behavior. | 110. Use Candlestick Patterns: Recognize patterns as they provide insights into market sentiment and potential reversals. |

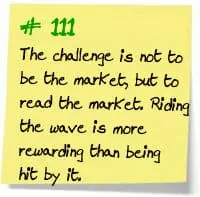

|

|

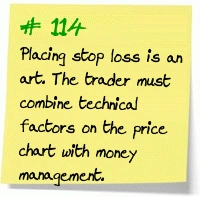

113. Be Aware of Tax Implications: Understand the tax obligations of your trading activities in your country. |  |

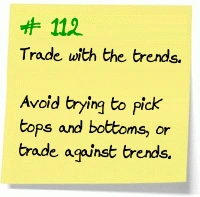

115. Trade with the Trend: “The trend is your friend” – trading with the prevailing trend increases success. |

| 116. Set Realistic Expectations: Understand that consistent profits take time; don’t expect to get rich overnight. | 117. Know When to Take a Break: If the market isn’t behaving as expected, it’s okay to step away and regroup. | 118. Use Fibonacci Retracement Levels: These can help identify potential support and resistance levels. | 119. Don’t Over-Leverage: Using too much leverage can lead to significant losses, so use it carefully and sparingly. | 120. Avoid Trading When Distracted: Focus is key in trading; avoid trading when you can’t fully concentrate. |

|

|

|

|

|

September 14, 2024. Version 1.1