The Ultimate Trading Guide: 41. Position Sizing

Position sizing is a critical aspect of trading that often differentiates successful traders from those who consistently lose money. It involves determining the amount of capital to allocate to each trade based on your risk tolerance, trading strategy, and market conditions. Effective position sizing helps manage risk, preserve capital, and optimize returns. This chapter of The Ultimate Trading Guide delves into the importance of position sizing, the methodologies for determining the appropriate size for each trade, and includes a comprehensive case study to illustrate these principles in practice.

The Importance of Position Sizing

Risk Management

The primary goal of position sizing is to manage risk. By determining how much of your capital to risk on each trade, you can limit potential losses to a level that is acceptable and sustainable. This helps prevent catastrophic losses that can wipe out your trading account.

Consistency

Position sizing promotes consistency in trading. By adhering to a systematic approach, traders can avoid emotional decision-making and impulsive trades. Consistency in position sizing helps maintain a disciplined trading strategy.

Capital Preservation

Effective position sizing helps preserve trading capital. By controlling the amount at risk, traders can survive losing streaks and stay in the game long enough to benefit from winning trades. Preserving capital is crucial for long-term trading success.

Optimizing Returns

Appropriate position sizing allows traders to optimize their returns. By adjusting the size of each trade based on the probability of success and risk-reward ratio, traders can maximize profits while minimizing risks.

Methods for Determining Position Size

Fixed Dollar Amount

One of the simplest methods for determining position size is to risk a fixed dollar amount on each trade. For example, a trader might decide to risk $100 on every trade, regardless of the size of their trading account. This method is easy to implement but does not account for changes in account size or volatility.

Percentage of Account

A more sophisticated approach is to risk a fixed percentage of your trading account on each trade. For example, a trader might decide to risk 2% of their account balance on each trade. This method adjusts the position size based on the account size, providing a more dynamic approach to risk management.

Volatility-Based Position Sizing

Volatility-based position sizing involves adjusting the position size based on the volatility of the asset being traded. Higher volatility assets require smaller position sizes to manage risk effectively, while lower volatility assets can accommodate larger position sizes. This method ensures that risk is adjusted for the inherent volatility of the asset.

Fixed Ratio Position Sizing

Fixed ratio position sizing involves increasing the position size as the trading account grows, but at a controlled rate. This method uses a predefined ratio to determine when to increase the position size. For example, a trader might increase the position size by one contract for every $1,000 increase in account equity.

Kelly Criterion

The Kelly Criterion is a mathematical formula used to determine the optimal position size based on the probability of success and the risk-reward ratio of the trade. While it can maximize returns, the Kelly Criterion can also result in aggressive position sizes that may not be suitable for all traders. It requires accurate estimation of probabilities and is best suited for experienced traders.

Steps to Determine Position Size

Step 1: Assess Risk Tolerance

The first step in determining position size is to assess your risk tolerance. This involves evaluating how much of your capital you are willing to risk on a single trade. Risk tolerance varies among traders and depends on factors such as trading experience, financial goals, and psychological comfort with risk.

Step 2: Set Risk Parameters

Once you have assessed your risk tolerance, set clear risk parameters for each trade. This includes determining the maximum percentage of your account that you are willing to risk and setting stop-loss levels to limit potential losses.

Step 3: Calculate Position Size

Calculate the position size based on your risk parameters and the specifics of the trade. This involves considering the entry price, stop-loss level, and the method you are using for position sizing (e.g., percentage of account, volatility-based).

Step 4: Adjust for Market Conditions

Adjust your position size based on current market conditions. This includes considering factors such as market volatility, liquidity, and the probability of success for the trade. Be flexible and willing to adjust your position size as conditions change.

Step 5: Review and Refine

Regularly review and refine your position sizing approach. Analyze the performance of your trades, evaluate your risk management strategies, and make adjustments as necessary. Continuous improvement is key to long-term success.

Case Study: John’s Position Sizing Strategy

John is a forex trader with a $50,000 trading account. He has been trading for two years and has developed a profitable trading strategy. However, he has struggled with managing risk and preserving capital. John decides to implement a position sizing strategy to improve his trading performance.

Assessing Risk Tolerance

John assesses his risk tolerance and determines that he is comfortable risking 1% of his account on each trade. This means he is willing to risk $500 per trade.

Setting Risk Parameters

John sets clear risk parameters for each trade. He decides to use a stop-loss order to limit his potential losses to $500. He calculates the stop-loss level based on the volatility of the currency pair he is trading.

Calculating Position Size

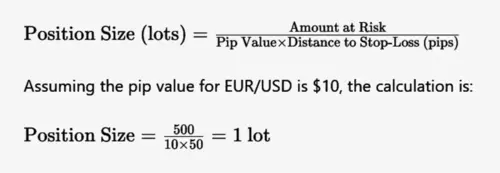

John uses the percentage of account method to calculate his position size. He determines the distance from his entry price to his stop-loss level in pips and uses this information to calculate the position size in lots.

For example, if John is trading EUR/USD and

the distance from his entry price to his stop-loss level is 50 pips, he

calculates the position size as follows:

Adjusting for Market Conditions

John adjusts his position size based on market conditions. If he is trading a more volatile currency pair, he reduces the position size to manage risk. Conversely, if he is trading a less volatile pair, he may increase the position size within his risk tolerance limits.

Reviewing and Refining

John regularly reviews his trading performance and refines his position sizing approach. He analyzes his trades, evaluates his risk management strategies, and makes adjustments as necessary. Over time, he becomes more confident in his ability to manage risk and optimize returns.

Outcome

By implementing a position sizing strategy, John improves his risk management and trading performance. He experiences fewer large losses and is able to preserve his capital during losing streaks. His disciplined approach to position sizing allows him to optimize his returns and achieve consistent profits.

Final Remarks

Position sizing is a fundamental aspect of successful trading. It involves determining the appropriate size for each trade based on your risk tolerance, trading strategy, and market conditions. Effective position sizing helps manage risk, preserve capital, and optimize returns.

In this chapter of The Ultimate Trading Guide, we have explored the importance of position sizing, the methodologies for determining the appropriate size for each trade, and a comprehensive case study illustrating these principles in practice. By assessing risk tolerance, setting clear risk parameters, calculating position size, adjusting for market conditions, and regularly reviewing and refining your approach, you can enhance your trading performance and achieve long-term success.

As you continue your trading journey, remember that position sizing is a dynamic and continuous process. Stay disciplined, remain flexible, and always be willing to adapt your strategies based on new information and changing market conditions. This balanced approach will help you navigate the complexities of the financial markets with confidence and achieve your trading goals.