The Ultimate Trading Guide: 43. Risk-Reward Ratio

In the complex world of trading, one of the most crucial concepts for achieving long-term success is the risk-reward ratio. This ratio, often abbreviated as R/R, is a measure of the potential profit a trader can expect to earn relative to the potential loss they might incur. A favorable risk-reward ratio can significantly enhance a trader's profitability by ensuring that the rewards outweigh the risks on a consistent basis. This chapter from "The Ultimate Trading Guide" by BellsForex.com delves into the importance of the risk-reward ratio, strategies for optimizing it, and provides a case study to illustrate its practical application.

Understanding the Risk-Reward Ratio

The risk-reward ratio is a simple yet powerful tool that helps traders assess the potential profitability of a trade relative to its risk. It is calculated by dividing the potential profit of a trade by the potential loss. For example, if a trader risks $100 to make $300, the risk-reward ratio is 1:3.

Key Components:

- Risk: The amount of money a trader is willing to lose on a trade. This is typically determined by the stop-loss level, which is the price at which the trade will be closed to prevent further losses.

- Reward: The potential profit a trader expects to make from a trade. This is usually determined by the take-profit level, which is the price at which the trade will be closed to secure profits.

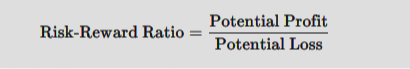

- Calculation: The risk-reward ratio is calculated as follows:

|

For instance, if a trader sets a stop-loss at $10 below the entry price and a take-profit at $30 above the entry price, the risk-reward ratio would be 1:3.

Importance of a Favorable Risk-Reward Ratio

A favorable risk-reward ratio is essential for several reasons:

- Profitability: Trades with a higher reward compared to risk can be profitable even if the win rate is relatively low. For example, with a 1:3 risk-reward ratio, a trader only needs to win 25% of their trades to break even.

- Risk Management: A favorable risk-reward ratio helps traders manage risk more effectively by ensuring that potential losses are limited while potential profits are maximized.

- Psychological Benefits: Knowing that the potential reward significantly outweighs the risk can provide traders with greater confidence and reduce the emotional stress associated with trading.

- Consistency: By consistently aiming for trades with favorable risk-reward ratios, traders can achieve more consistent and sustainable returns over time.

Strategies for Optimizing the Risk-Reward Ratio

To optimize the risk-reward ratio, traders should consider several strategies:

- Setting Realistic Targets: Traders should set realistic take-profit levels based on market conditions, technical analysis, and historical price movements. Unrealistic targets can lead to missed opportunities and increased risk.

- Using Stop-Loss Orders: Properly placed stop-loss orders are essential for managing risk. Traders should set stop-loss levels based on technical indicators, support and resistance levels, and overall market conditions.

- Analyzing Market Conditions: Understanding the prevailing market conditions can help traders identify high-probability trades with favorable risk-reward ratios. This includes analyzing trends, volatility, and key economic events.

- Adjusting Position Sizes: Position sizing should be adjusted based on the risk-reward ratio. Larger positions can be taken on trades with higher reward potential, while smaller positions are suitable for trades with lower reward potential.

- Reviewing and Refining Strategies: Regularly reviewing past trades and refining strategies based on performance can help traders improve their risk-reward ratios over time.

Case Study: Applying the Risk-Reward Ratio in Forex Trading

To illustrate the practical application of the risk-reward ratio, let's

consider a hypothetical case study of a trader named John.

Trader Profile: John is an experienced forex

trader who primarily trades

major currency pairs. He uses a combination of technical analysis and

price action strategies to identify trading opportunities. John has

recently decided to focus on optimizing his risk-reward ratio to improve

his trading performance.

Trade Scenario: In February 2024, John identified a potential trading opportunity in the EUR/USD pair. The pair was in an uptrend, and John noticed a bullish flag pattern forming on the daily chart. Based on his analysis, he believed that a breakout above the resistance level of 1.1200 could lead to a significant upward move.

Trade Setup:

- Entry Point: John planned to enter a long position if the EUR/USD pair broke and closed above 1.1200 on the daily chart.

- Stop-Loss Level: He set a stop-loss order just below the flag pattern at 1.1100 to manage risk.

- Take-Profit Level: Based on the height of the flag pattern, John set his take-profit level at 1.1500, offering a potential reward of 300 pips.

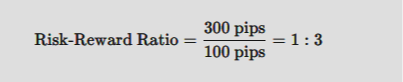

Risk-Reward Calculation:

- Risk: The stop-loss level was 100 pips below the entry point (1.1200 - 1.1100).

- Reward: The take-profit level was 300 pips above the entry point (1.1500 - 1.1200).

- Risk-Reward Ratio:

|

Trade Execution:

- On February 10, 2024, the EUR/USD pair broke and closed above 1.1200, confirming the bullish flag breakout. John entered a long position at 1.1210.

- He placed his stop-loss order at 1.1100 and his take-profit order at 1.1500.

Outcome:

- Over the next two weeks, the EUR/USD pair continued to rise, reaching John's take-profit level at 1.1500. He exited the trade with a 290-pip profit.

- By focusing on a favorable risk-reward ratio, John was able to enter a high-probability trade with a significant reward relative to the risk.

Post-Trade Analysis:

- John reviewed his trading journal and noted the effectiveness of using the bullish flag pattern and setting realistic take-profit and stop-loss levels.

- He also recognized the importance of patience in waiting for the confirmed breakout and adhering to his trading plan.

Final Remarks

A favorable risk-reward ratio is a fundamental aspect of successful trading. By aiming for trades where the potential reward outweighs the risk, traders can enhance their profitability, manage risk more effectively, and achieve more consistent results. The case study of John illustrates how optimizing the risk-reward ratio can lead to successful trading outcomes.

To achieve a favorable risk-reward ratio, traders should set realistic targets, use properly placed stop-loss orders, analyze market conditions, adjust position sizes, and regularly review and refine their strategies. By incorporating these practices into their trading routine, traders can improve their decision-making processes and achieve long-term success in the financial markets.

As part of The Ultimate Trading Guide, this chapter emphasizes that the risk-reward ratio is not just a mathematical concept but a practical tool that can significantly impact a trader's performance. By consistently aiming for trades with favorable risk-reward ratios, traders can navigate the complexities of the financial markets with greater confidence and achieve sustainable success.