The Ultimate Trading Guide: 54. Scalping

Scalping is a fast-paced trading strategy that involves making numerous small trades to profit from minor price changes. This method of trading requires quick decision-making, precise execution, and a solid understanding of market dynamics. As a chapter from The Ultimate Trading Guide, this essay explores the intricacies of scalping, its advantages and challenges, key techniques, and includes a case study to illustrate its practical application.

Understanding Scalping

Scalping is a trading strategy focused on taking advantage of small price movements within the market. Unlike other trading strategies that aim for significant price changes, scalpers seek to profit from incremental price shifts over a short period, often seconds to minutes. The primary goal is to accumulate a series of small gains that collectively add up to a significant profit.

Key Characteristics:

- High Frequency: Scalping involves a high number of trades, often executed within minutes or even seconds.

- Small Targets: Scalpers target small price changes, typically a few pips or ticks.

- Short Holding Period: Positions are held for a very short time to minimize exposure to market risks.

- Leverage: Scalpers often use leverage to amplify their small gains, making the strategy potentially profitable despite minor price movements.

Advantages of Scalping

Scalping offers several benefits that make it an attractive strategy for traders:

- Reduced Risk Exposure: By holding positions for a brief period, scalpers minimize the risk of adverse market movements.

- Consistent Opportunities: Scalping can be practiced in various market conditions, providing numerous trading opportunities.

- Lower Impact of Fundamental Analysis: Scalping relies heavily on technical analysis and price action, reducing the need for in-depth fundamental analysis.

- High Probability of Small Gains: Frequent small gains can accumulate into substantial profits over time.

Challenges of Scalping

Despite its advantages, scalping also presents several challenges:

- High Transaction Costs: The large number of trades can lead to significant transaction costs, including spreads and commissions.

- Intense Focus Required: Scalping demands constant attention and quick decision-making, which can be mentally exhausting.

- Risk of Overtrading: The fast-paced nature of scalping can lead to overtrading, increasing the risk of losses.

- Technological Dependence: Scalping requires advanced trading platforms and tools for rapid execution and real-time data analysis.

Key Techniques in Scalping

To successfully implement a scalping strategy, traders need to employ specific techniques and tools:

- Technical Analysis: Scalpers rely heavily on technical analysis to identify entry and exit points. Key tools include moving averages, Bollinger Bands, and oscillators such as the RSI and MACD.

- Price Action: Understanding price action is crucial for scalpers. This involves analyzing candlestick patterns, support and resistance levels, and trend lines to predict short-term price movements.

- Order Types: Scalpers use various order types, including market orders, limit orders, and stop orders, to ensure precise execution. Limit orders can help in avoiding slippage, while stop orders can protect against significant losses.

- Time Frames: Scalping typically involves using very short time frames, such as 1-minute or 5-minute charts, to capture small price movements.

- Liquidity: Scalpers prefer highly liquid markets and instruments to ensure smooth and quick execution of trades. Forex majors, high-volume stocks, and certain commodities are popular choices.

- Risk Management: Effective risk management is vital in scalping. This includes setting strict stop-loss levels, limiting the amount of capital at risk per trade, and avoiding overleveraging.

Case Study: Scalping in Forex Trading

To illustrate the practical application of scalping, let’s consider a hypothetical case study of a trader named Sarah.

Trader Profile: Sarah is an experienced forex trader who specializes in scalping the EUR/USD pair. She uses a combination of technical indicators and price action analysis to identify trading opportunities. Sarah trades during the European and U.S. market sessions when liquidity and volatility are highest.

Scalping Strategy:

1. Technical Setup:

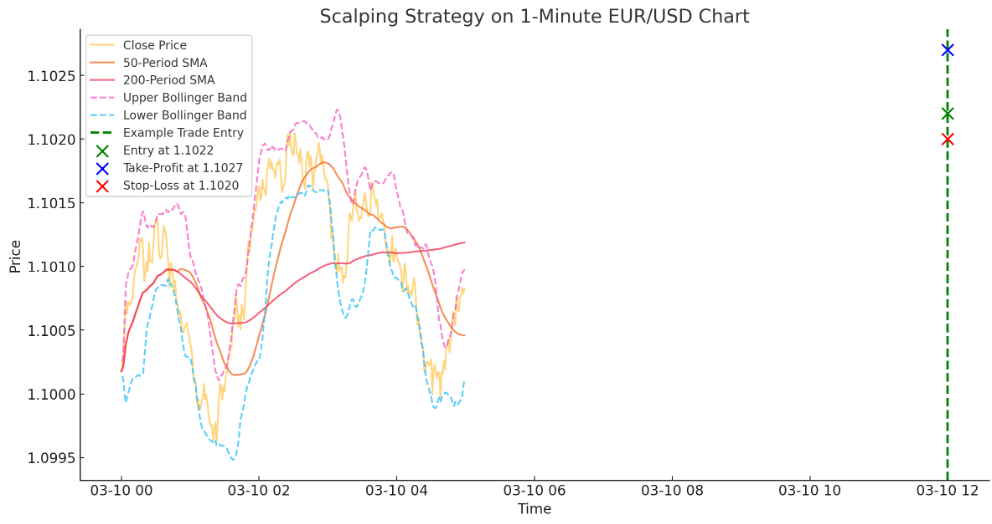

- Chart Time Frame: 1-minute chart

- Indicators Used: 50-period and 200-period moving averages, Bollinger

Bands, and the RSI (Relative Strength Index)

2. Entry Criteria:

- Sarah looks for a confluence of signals indicating a potential price move. For a long trade, she waits for the price to bounce off the lower Bollinger Band while the RSI is below 30 (indicating an oversold condition) and the price is above the 50-period moving average but below the 200-period moving average.

- For a short trade, she waits for the price to touch the upper Bollinger Band while the RSI is above 70 (indicating an overbought condition) and the price is below the 50-period moving average but above the 200-period moving average.

3. Exit Criteria:

- Sarah sets a take-profit target of 5 pips and a stop-loss of 2 pips for each trade. This ensures a favorable risk-reward ratio of 1:2.5.

4. Trade Execution:

- Sarah uses limit orders to enter trades at precise price levels and avoid slippage. She also sets stop-loss and take-profit orders simultaneously to manage risk effectively.

Trade Example:

On March 10, 2024, during the European session, Sarah observes the following setup on the EUR/USD 1-minute chart:

- The price bounces off the lower Bollinger Band at 1.1020.

- The RSI drops below 30, indicating an oversold condition.

- The price is above the 50-period moving average but below the 200-period moving average.

Based on her strategy, Sarah enters a long position at 1.1022 with a 5-pip take-profit target at 1.1027 and a 2-pip stop-loss at 1.1020.

Outcome:

- Within two minutes, the price reaches her take-profit level at 1.1027, and Sarah exits the trade with a 5-pip profit.

- She repeats this process multiple times during the session, consistently applying her strategy and managing risk.

Post-Trade Analysis:

At the end of the trading session, Sarah reviews her trades and notes the following:

- She executed 30 trades, with 22 winners and 8 losers.

- Total pips gained: (22 trades x 5 pips) - (8 trades x 2 pips) = 110 pips - 16 pips = 94 pips.

- Net profit: 94 pips.

Sarah's disciplined approach, adherence to her scalping strategy, and effective risk management resulted in a profitable trading session.

Final Remarks

Scalping is a high-frequency trading strategy that can yield significant profits through numerous small trades. By focusing on minor price changes and executing trades with precision, scalpers can accumulate substantial gains over time. However, scalping requires intense focus, quick decision-making, and advanced technological tools.

The case study of Sarah illustrates the practical application of scalping in forex trading. By using technical indicators, price action analysis, and strict risk management, Sarah was able to execute a series of successful trades and achieve a profitable outcome.

As part of The Ultimate Trading Guide, this chapter emphasizes that scalping is not for everyone. It demands a specific skill set, including the ability to stay focused under pressure and the discipline to adhere to a well-defined strategy. Traders interested in scalping should start with a solid understanding of market dynamics, practice their techniques, and continually refine their approach to achieve success.

In conclusion, scalping offers a unique opportunity for traders to profit from minor price changes. By mastering this strategy, traders can take advantage of numerous trading opportunities, manage risk effectively, and potentially achieve consistent profits in the fast-paced world of financial markets.