The Ultimate Trading Guide: 56. Breakout Trading

Breakout trading is a popular strategy that seeks to capitalize on significant price movements when the price breaks through established support or resistance levels. This approach is based on the idea that once a price breaches a critical level, it often continues to move in the breakout direction, presenting a trading opportunity. This chapter from "The Ultimate Trading Guide" by BellsForex explores the fundamentals of breakout trading, its advantages, key strategies, and provides a comprehensive case study to illustrate its practical application.

Understanding Breakout Trading

Definition and Concept

A breakout occurs when the price of a financial instrument moves outside a defined support or resistance level with increased volume. Support levels are price points where an asset tends to stop falling due to a concentration of demand, while resistance levels are price points where the asset tends to stop rising due to a concentration of supply. Breakout trading involves entering a trade when the price breaks through these levels, expecting the momentum to continue in the direction of the breakout.

Key Characteristics

- Volume Confirmation: Significant volume increases often accompany breakouts, indicating strong interest and potential continuation in the breakout direction.

- Volatility: Breakouts usually lead to increased volatility, offering traders opportunities for substantial gains.

- Defined Entry and Exit Points: Breakout trading provides clear entry and exit points based on technical levels.

- Time Frame: Breakout strategies can be applied across various time frames, from intraday to long-term trading.

Advantages of Breakout Trading

Potential for Significant Profits

Breakout trading aims to capture substantial price movements that occur when price breaks out of a consolidation phase. These moves can lead to significant profits, especially if the breakout is strong and sustained.

Clear Entry and Exit Signals

The strategy offers well-defined entry and exit points based on technical levels. Traders can set precise buy or sell orders at the breakout level and place stop-loss orders to manage risk.

Applicability Across Markets

Breakout trading can be applied to various financial instruments, including stocks, forex, commodities, and cryptocurrencies. The principles of breakouts are universal, making this strategy versatile and adaptable.

Minimized Time in Market

Compared to long-term strategies, breakout trading can result in shorter trade durations. This can reduce exposure to market risks and the emotional stress of holding positions for extended periods.

Key Strategies for Breakout Trading

Identifying Breakout Candidates

- Chart Patterns: Common patterns that indicate potential breakouts include triangles (ascending, descending, and symmetrical), rectangles, flags, and pennants.

- Support and Resistance Levels: Identifying key support and resistance levels is crucial for spotting potential breakout points.

- Technical Indicators: Tools like Bollinger Bands, Moving Averages, and the Relative Strength Index (RSI) can help identify conditions ripe for breakouts.

Entry and Exit Strategies

- Volume Confirmation: Ensure the breakout is accompanied by increased volume, which indicates strong interest and likelihood of continuation.

- Wait for a Retest: Sometimes, prices break out and then retest the breakout level before continuing. Entering on the retest can provide a safer entry point.

- Stop-Loss Orders: Place stop-loss orders just below the breakout level for long positions or just above for short positions to manage risk.

- Take-Profit Targets: Set profit targets based on the distance between the support and resistance levels or using technical indicators like the Average True Range (ATR).

Risk Management

- Position Sizing: Determine the appropriate amount of capital to risk on each trade based on your overall risk tolerance.

- Risk-Reward Ratio: Aim for a favorable risk-reward ratio (e.g., 1:2 or 1:3) to ensure potential profits outweigh potential losses.

- Trailing Stops: Use trailing stops to lock in profits as the price moves in your favor while protecting against reversals.

Case Study: Breakout Trading in the Forex Market

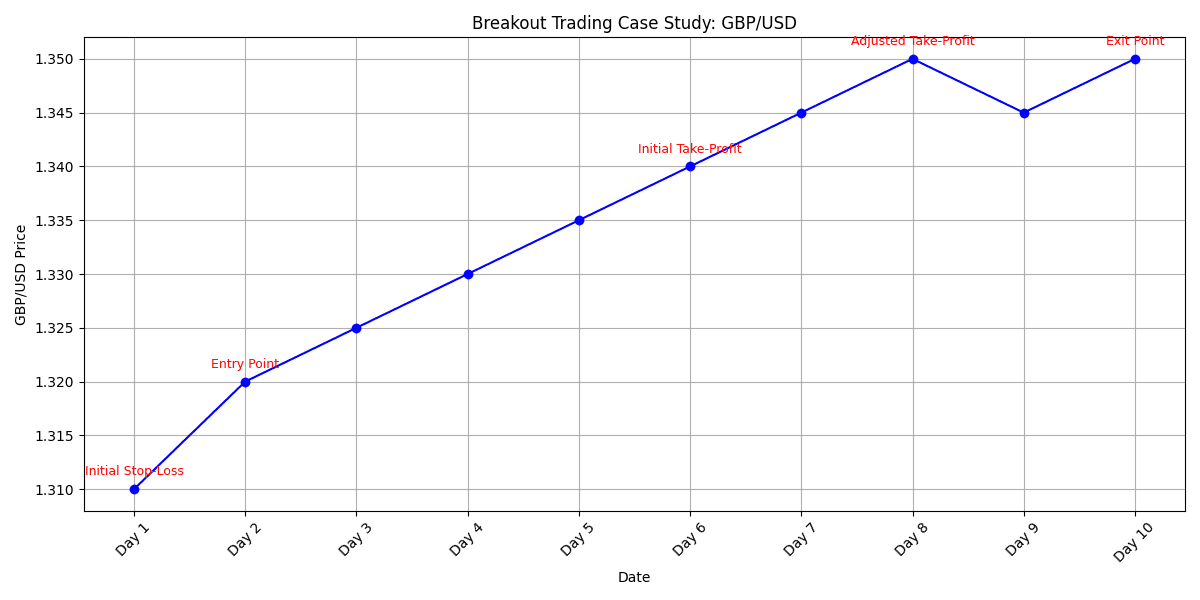

Emma, an experienced forex trader, decided to apply breakout trading strategies to the GBP/USD currency pair. By leveraging technical analysis and disciplined risk management, Emma aimed to capture gains from significant price movements.

Initial Analysis

Emma began by conducting a thorough analysis of the GBP/USD pair. She reviewed historical price data and identified key support and resistance levels. Using a combination of chart patterns and technical indicators, Emma assessed the current trend and potential breakout points.

- Chart Patterns: Emma identified a symmetrical triangle pattern forming over several weeks, indicating a potential breakout scenario.

- Support and Resistance Levels: The resistance level was at 1.3200, and the support level was at 1.3000.

- Technical Indicators: The Bollinger Bands were narrowing, indicating decreased volatility and an impending breakout.

Entry Point

Emma waited for the price to break out of the symmetrical triangle. When the GBP/USD pair broke above the resistance level at 1.3200 with increased volume, Emma initiated a long position, anticipating a continuation of the upward momentum.

Risk Management

To manage risk, Emma set a stop-loss order just below the breakout level at 1.3100. This placement limited her potential loss to 100 pips. Additionally, she set a take-profit order at 1.3400, targeting a move of 200 pips. This setup provided a risk-reward ratio of 1:2, aligning with Emma's trading plan.

Trade Execution and Monitoring

Over the next few days, the GBP/USD pair continued to rise, reflecting the bullish momentum. Emma closely monitored the trade, paying attention to volume and price action to ensure the breakout remained valid.

Adjustments and Outcome

As the price approached the 1.3400 target, Emma noticed a bullish continuation pattern (a flag) forming on the chart. To maximize her profits, she adjusted her take-profit order to 1.3500 and moved her stop-loss order to the breakeven point at 1.3200, effectively eliminating risk on the trade.

Eventually, the GBP/USD reached the adjusted target of 1.3500, and Emma's take-profit order was triggered. She exited the trade with a profit of 300 pips, successfully capitalizing on the breakout.

Lessons Learned

- Volume Confirmation: Emma ensured the breakout was confirmed by increased volume, which validated the trade setup.

- Risk Management: Setting stop-loss and take-profit orders helped Emma manage risk and lock in profits.

- Flexibility and Adaptation: Adjusting her take-profit target based on evolving price patterns allowed Emma to maximize her gains.

Final Remarks

Breakout trading offers a compelling approach for traders looking to capitalize on significant price movements. By identifying key support and resistance levels, using technical indicators, and implementing disciplined risk management, traders can enhance their profitability and achieve consistent results. The case study of Emma's forex trade highlights the practical application of breakout trading strategies and underscores the importance of volume confirmation, risk management, and adaptability.

We believe that breakout trading can be a valuable addition to a trader's toolkit. Whether you're a novice or an experienced trader, mastering breakout trading requires a commitment to regular analysis, risk management, and continuous learning. By following the principles outlined in this chapter of The Ultimate Trading Guide, traders can navigate the complexities of financial markets with greater confidence and achieve their trading goals.