The Ultimate Trading Guide: 8. Keep a Trading Journal

Trading in the financial markets is as much an art as it is a science. Success in trading requires not only knowledge and skill but also continuous learning and improvement. One of the most effective tools for achieving this is a trading journal. By meticulously recording your trades, strategies, and outcomes, you can analyze your performance, identify strengths and weaknesses, and make informed adjustments to your approach. This essay explores the importance of keeping a trading journal, outlines what to include in it, and presents a case study to illustrate its benefits.

Importance of Keeping a Trading Journal

A trading journal is more than just a record of transactions; it is a comprehensive log that captures the essence of your trading journey. Here are some key reasons why maintaining a trading journal is crucial:

- Self-Awareness and Accountability: A trading journal helps traders become more self-aware and accountable for their actions. By documenting each trade and the rationale behind it, traders can track their decision-making processes and identify patterns in their behavior.

- Performance Analysis: Reviewing your trading journal allows you to analyze your performance over time. You can assess which strategies are working, which are not, and make data-driven decisions to refine your approach.

- Learning from Mistakes: Mistakes are inevitable in trading, but they can be valuable learning opportunities. A trading journal helps you understand what went wrong, why it happened, and how to avoid similar mistakes in the future.

- Emotional Control: Emotions play a significant role in trading. By recording your emotional state and psychological factors influencing your trades, you can gain insights into how emotions impact your decisions and develop strategies to manage them better.

- Strategy Development: A trading journal provides a structured way to test and refine trading strategies. By tracking the outcomes of different strategies, you can determine their effectiveness and make necessary adjustments.

- Improved Discipline: The process of maintaining a trading journal instills discipline. It encourages you to follow your trading plan and adhere to predefined rules, reducing impulsive and irrational decisions.

What to Include in a Trading Journal

A comprehensive trading journal should capture various aspects of your trading activities. Here are the essential components to include:

- Trade Details

- Date and Time: Record the date and time of each trade to understand market conditions during different periods.

- Instrument: Specify the asset being traded, such as stocks, forex pairs, commodities, or cryptocurrencies.

- Entry and Exit Points: Note the price levels at which you entered and exited the trade.

- Trade Rationale

- Strategy Used: Describe the trading strategy or setup that prompted the trade. This could include technical indicators, chart patterns, or fundamental analysis.

- Market Conditions: Document the prevailing market conditions, such as trends, volatility, and key news events.

- Position Size and Risk Management

- Position Size: Record the number of units or shares traded.

- Stop-Loss and Take-Profit Levels: Note the stop-loss and take-profit levels set for the trade to manage risk and reward.

- Trade Outcome

- Profit or Loss: Calculate the profit or loss from the trade in both absolute terms and as a percentage of your account balance.

- Risk/Reward Ratio: Assess the risk/reward ratio of the trade to evaluate its risk management effectiveness.

- Emotional and Psychological Factors

- Emotional State: Reflect on your emotional state before, during, and after the trade. Were you feeling confident, anxious, or stressed?

- Psychological Influences: Identify any psychological factors that influenced your decisions, such as fear of missing out (FOMO) or overconfidence.

- Post-Trade Analysis

- Lessons Learned: Summarize the key takeaways from the trade. What went well? What could be improved?

- Adjustments: Note any adjustments or changes you plan to make to your trading strategy or approach based on the trade's outcome.

Case Study: Using a Trading Journal

To illustrate the benefits of a trading journal, let's consider a hypothetical case study of a trader named Sarah.

Trader Profile: Sarah is an intermediate forex trader who has been trading for two years. She uses a combination of technical analysis and price action strategies to make her trading decisions. Sarah decides to keep a trading journal to improve her performance and gain deeper insights into her trading behavior.

Trade Example

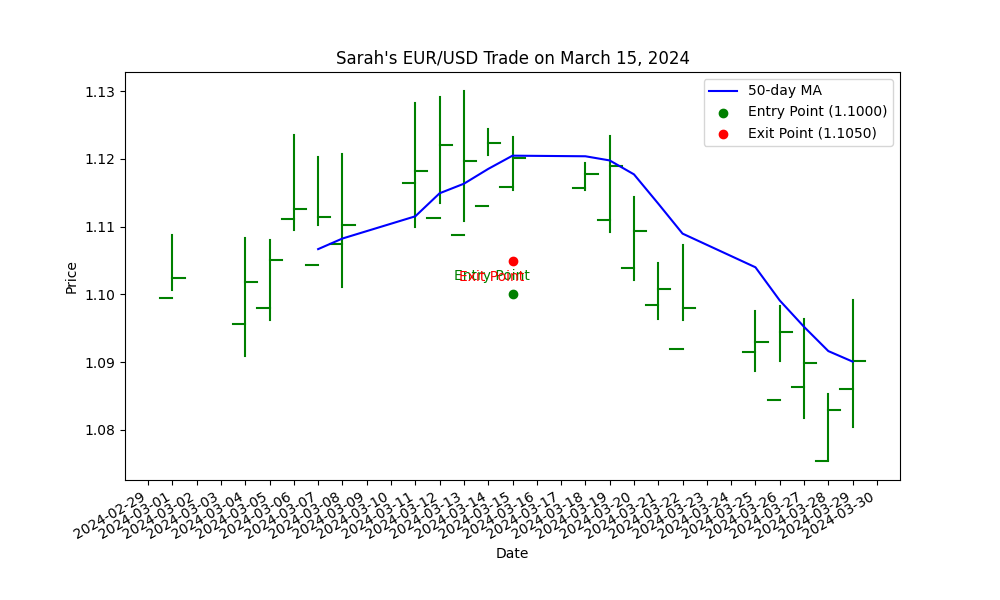

- Date and Time: March 15, 2024, 09:30 AM

- Instrument: EUR/USD

- Entry Point: 1.1000

- Exit Point: 1.1050

Trade Rationale

- Strategy Used: Sarah used a trend-following strategy based on the 50-day moving average and a bullish engulfing candlestick pattern at a key support level.

- Market Conditions: The EUR/USD pair was in an uptrend, supported by positive economic data from the Eurozone.

Position Size and Risk Management

- Position Size: 1 lot (100,000 units)

- Stop-Loss Level: 1.0950

- Take-Profit Level: 1.1050

Trade Outcome

- Profit or Loss: Profit of 50 pips, equivalent to $500.

- Risk/Reward Ratio: The risk/reward ratio was 1:1, with a 50-pip stop-loss and a 50-pip take-profit.

Emotional and Psychological Factors

- Emotional State: Sarah felt confident entering the trade due to the clear trend and supportive economic data. However, she experienced some anxiety as the price approached the take-profit level.

- Psychological Influences: The fear of missing out (FOMO) made her consider closing the trade early, but she adhered to her trading plan.

Post-Trade Analysis

- Lessons Learned: Sarah's disciplined approach to sticking with her trading plan and trusting her analysis paid off. She recognized the importance of managing emotions and not deviating from her strategy.

- Adjustments: Sarah decided to further refine her entry criteria by incorporating additional confirmation signals to increase the reliability of her trades.

- Outcome and Insights: By keeping a trading journal, Sarah was able to review her trade in detail, analyze her decision-making process, and identify areas for improvement. She realized the importance of emotional control and discipline in achieving consistent trading results.

Over time, Sarah's journal became an invaluable resource for tracking her progress, refining her strategies, and learning from both successes and failures.

Final Remarks

Maintaining a trading journal is an essential practice for traders seeking to improve their performance and achieve long-term success. By systematically recording trades, strategies, and outcomes, traders can gain valuable insights into their behavior, refine their strategies, and make data-driven decisions. A trading journal fosters discipline, accountability, and continuous learning, all of which are critical components of successful trading.

As demonstrated in the case study of Sarah, a trading journal helps traders understand the impact of their emotions, evaluate the effectiveness of their strategies, and make informed adjustments to enhance their performance. Whether you are a novice or an experienced trader, the benefits of keeping a trading journal cannot be overstated. It is a powerful tool that not only documents your trading journey but also guides you toward becoming a more disciplined, strategic, and successful trader.